The $6K Reality Check that Changed My Budget

In September I spent $492.17 on Door Dash. That’s a damn car payment.

After budgeting for the last couple of years, I still never seemed to have much wiggle room. I finally took an honest look at my bank statements to identify the major leak.

I found it…Ordering extra groceries, meals, and toiletries on Door Dash. :-|

How I Got Into this Mess

I’ve been using Door Dash consistently for many years.

I used to think I was just paying for dinner or saving time by ordering my groceries, but really, I was paying for my own laziness on repeat.

Also, when I was a heavy drinker, I leaned on Door Dash to get me food (and more alcohol) for those times when I didn’t need to get behind the wheel.

Believe it or not, this number used to be higher. I checked my statement from December 2024 and it was $571.85.

The Hidden Costs

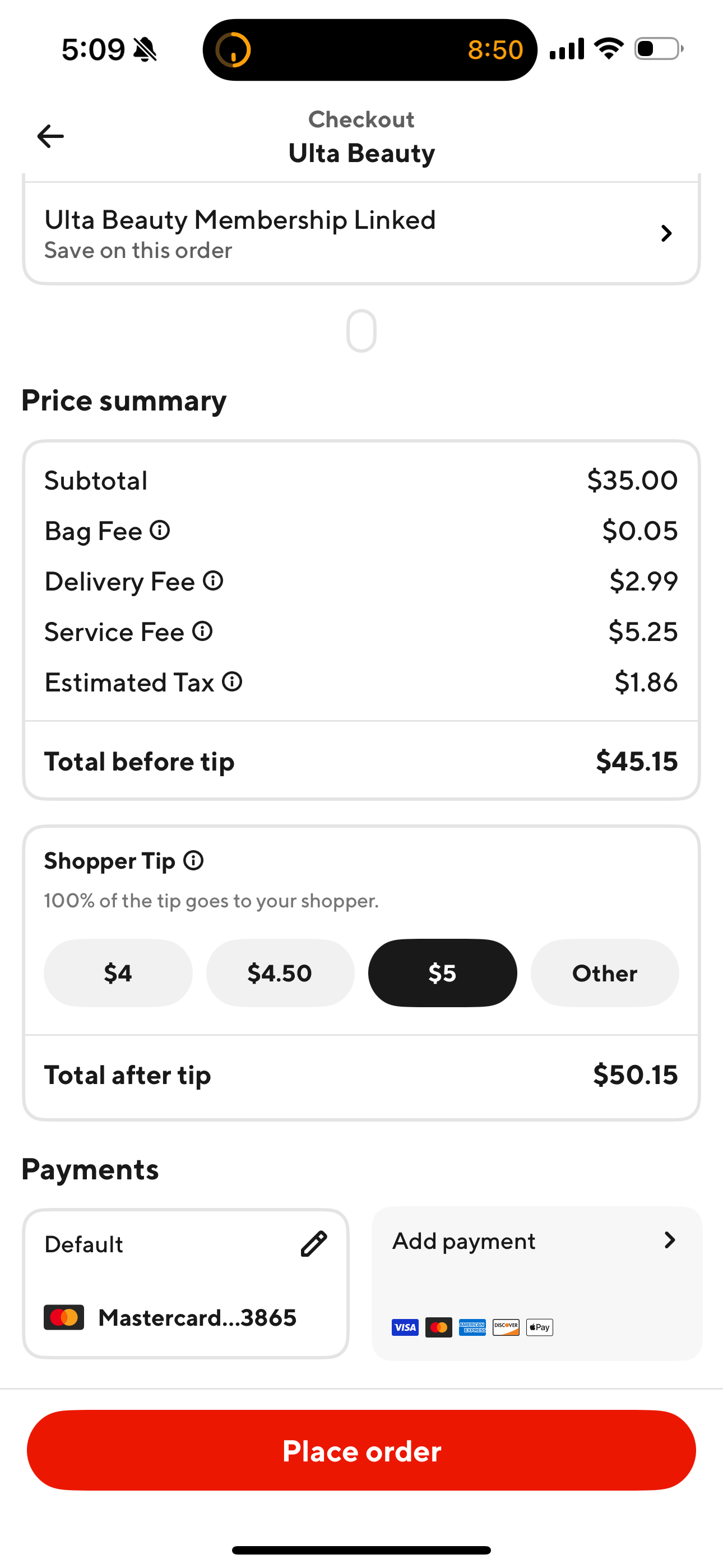

About a week ago I needed hair dye, so out of routine, I went on the app to order it.

My $35 purchase quickly turned into $50 after all the fees and tip. I paused before hitting submit and told myself, “Enough is enough,” hopped in the car and went to get my own damn hair dye.

Not only are there service fees and tipping the driver, but Door Dash (or the retailer/restaurant) charges an upsell for each item.

So, a $3 loaf of bread in the store can actually cost $3.35 or more when you purchase it via the Door Dash app.

How I Am Stopping the Leak For Good

I am in no position to waste money on this convenience.

I decided to finally move on and deleted the app and my account forever.

I have to admit that I was a little nervous to delete my account completely. Silly, I know - but I love relying on the app for those weekends when I don’t feel like leaving my apartment.

A Better Way

Before heading home Friday, I stocked up for the weekend. My first weekend without the app wasn’t nearly as hard as I thought it would be.

Door Dash might not be your leak. Maybe it’s Amazon or subscriptions you forgot about. But we all have one.

For me it was $492 in a single month. That’s nearly $6,000 a year.

Six grand isn’t small money.

That’s an emergency fund, a debt payoff, or my mom’s birthday trip to London.

I refuse to hand it to Door Dash anymore.

How I Paid Off $1,281.56 in 31 Days (On A Low Income)

As a child, my dad always stressed saving money & investing (while making me watch Suze Orman lol) and my mom stayed on my ass about the importance of an excellent credit score and budgeting.

Knowing what to do is one thing, but executing is a different ball game.

I’ve been “bad” with money for most of my life.

Overdrawn checking accounts.

Bankruptcy at 22 (I still don’t know why Navy Federal gave me a $20K chile!).

Zero in savings.

Underemployed.

Cash Advances.

500 credit score.

Robbing Peter to Pay Paul.

Any dicey financial situation you can imagine — I’ve been there.

Starting Balance 2-28-2025: $13,716.24 (not including student loans)

Amount I Paid Off in March 2025 - $1,281.56

Currently: $12,434.68

My Money Story

I haven’t reflected enough on this, but off the top of my head, my first real experience with money was as a teenager. I bounced around from every part-time job you could imagine — tons of cold calling telemarketing (blah), pretending I knew the best hair dye for customers at Sally’s Beauty Supply (lol), bagging groceries at Food Lion, working customer service at Best Buy, etc.

If they paid me...I was there - even if for a few weeks….and usually only for a few weeks.

High School…around 1997

I remember racing to the bank to deposit my $200 paycheck biweekly.

When the money cleared my account, I had to find a way to spend it immediately. I was good friends with TJ Maxx, Wendy’s, Wal-Mart, and Foot Locker.

It wasn’t like I didn’t know much about personal finance… As a child, my dad always stressed saving money & investing (while making me watch Suze Orman lol) and my mom stayed on my ass about the importance of an excellent credit score and budgeting.

Knowing what to do is one thing, but executing is a different ball game.

I’ve been “bad” with money for most of my life.

Overdrawn checking accounts.

Bankruptcy at 22 (I still don’t know why Navy Federal gave me a $20K chile!).

Zero in savings.

Underemployed.

Cash Advances.

500 credit score.

Robbing Peter to Pay Paul.

Any dicey financial situation you can imagine — I’ve been there.

The Decision

After racking up even more credit card and personal loans debts in 2024 to help my son, I promised myself that I will execute on paying off balances, save, and give myself grace as I navigate this journey. I started paying off credit cards and personal loans with minimal balances in early January, but March motivated me to take hard steps to look at my complete financial picture. The reality: I have an income problem - I have to find ways to increase my money.

How I Paid Off $1,281.56 in 31 Days:

I wrote down all my debts. I had a ballpark figure in January, but it was eye-opening to see the real numbers. This step is so hard for many of us, but it is necessary. How will we know where to start when you don’t have all the facts? Refund check from school - I received a small refund check from school and planned to use it towards debt. As soon as the money hit my account, I went on a damn shopping spree at the mall of all places. Fortunately, after two weeks, I got it together and returned purchases I hadn’t used yet (approximately $250).

I started DoorDash as a side hustle. On February 28th, I started doing DoorDash for extra cash. I live within walking distance of so many restaurants and stores, so the app is always busy near me. My car is over ten years old, so I try to stay within a five-mile radius for deliveries and never take orders under $6.

What I Did to Stay on Track

I listened to several audiobooks in March to keep myself on track and help with my mindset. Financial/Business Books I Listened to: We Should All Be Millionaires (10/10), You Need A Budget (10/10), and Love Your Life, Not Theirs (5/10).

Focused on one debt at a time and watched that balance like a hawk. - After seeing the real numbers, I decided the order of the debts I would like to pay off, then focused on each debt at a time. Instead of obsessing over the total amount (overwhelming), I obsessed over one balance and made a game out of it. I would go out and plan to make $60 on DoorDash, cash it out, and immediately apply that money to the balance. I was racing to zero, which was more fun than expected.

Your First Step

Do you know how much you owe in debt? Not an approximate number, but the real number. Pull the Band-Aid off and get those numbers on paper, no matter how scary this is. Don’t forget small loans you may owe to a family member or that $20 coinsurance you forgot to pay last year for lab work. Get it all on paper. It truly is the first step.

Can you relate to any of this? Leave a comment below. I would love to hear from you.

P.S. My income is “low” because I make $53,000 per year, while the median income in my region (Washington, DC) is $142,583. We’ll discuss my plans to increase my income with my current job and build my business in future blog posts.

Thank you for being here.